Weather Based Crop Insurance Platform built on Blockchain

Gram Cover

Stage of adaption :

Cultivation Stage/Post-Harvest Stage

TECHNOLOGY BRIEF

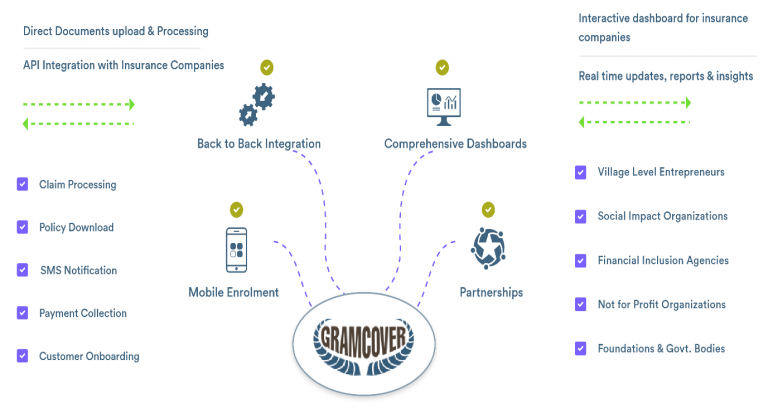

GramCover is working in the direction of managing the operations related to insurance claim settlement related to agriculture by providing transparent system. The solution covers configurable crop insurance policy definitions being created and their complete trail throughout the process involving all entities from issuance to claim settlement. Each transaction corresponding to policy issuance, claim and other information will be registered on Blockchain and system shall enable automatic or semi-automatic claim settlements using smart contracts. The platform consists of • Mobile Insurance Platform to be used by POSPs for enrolling farmers digitally. Collected farmer data feeds into the blockchain platform. • Insurance Contracts between farmer and insurance company are digitally codified as SmartContracts on the platform. • Data from Automated Weather Stations is pulled on the blockchain platform automatically. • Real Time Claim calculations take place based on thresholds defined in Smart Contracts. • Whenever a weather parameter hits the threshold, smart contract executes and insurance company and farmer are notified in real time thus bringing in the transparency in the whole system.

BENEFITS

Decentralization: There are different stakeholders viz., Insurer, Broker, Farmer and Regulatory Authorities (optional), involved, in order to make the system more reliable in terms of compliance, there would not be any single authority to maintain the logs of transaction related to trade and doing the settlement in case of discrepancy among the entities.

Immutability: Once the transaction gets register on to the blockchain, it will not be possible to make the changes with the record. So, the GramCover’s insurance claim settlement in respect of compliance can be maintained without any risk of mutability.

Security: Only the stakeholder who is going to host the node (optional) in the network will have the access to view transactions happening against each policy. So, no one can interfere in the system.

Transparency: Every transaction count, anyone can come and investigate the records but will not be able to modify.

TECHNOLOGY READINESS

Acquired more than 100 customers

Currently the platform is operational for distributing Weather based crop insurance product developed in collaboration with HDFC Ergo for Nasik(Maharastra) Grape Growers.

We sold close to 163 custom crop insurance policies on the platform.

The platform created can be scaled globally for Index based crop insurance schemes. We are in discussions with insurers to utilize this platform for other products.

This project won the World Bank Group’s Global Agri Insuretech Challenge and received a grant of 50,000 USD.

INTELLECTUAL PROPERTY

Technology Not Protected

CERTIFICATION

Not Applicable

TARGET CUSTOMERS

• Farmers

• Insurance Companies

• Government

SCALABILITY

The product is hosted in cloud and architected to scale

LIMITATIONS

None

TECHNOLOGY COST

This depends on scale and customization requiremenrt.

SOCIAL IMPACT

This solution will bring in transparency in advocating the Weather based Crop Insurance Schemes.

Decreases cost and time in the entire process from enrolment to claim settlement.

CONTACT

kisanmitr@indiancst.in

TOLL FREE

1800 258 2010

ONLINE HELP DESK

+91 97 429 79 111